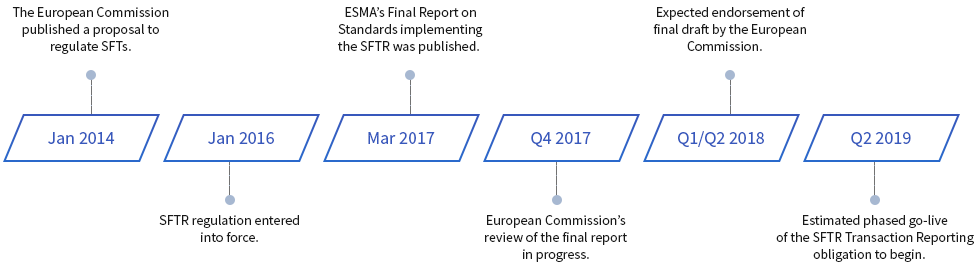

SFTR which is very similar to EMIR will be implemented in the coming year i.e. 2019. What do we think will data management for SFTR be a big challenge? I believe it will not be a fight which cannot be won, as financial firms have already had quite an exposure with EMIR and MIFID II requirements, then managing SFTR guidelines will not be big of a hassle if data management is streamlined and planned well.

The European Commission primarily to increase the transparency of Securities Financing Transactions markets, which currently is not been covered through any of the regulations has come up with this regulatory regime. The said regulation would mandate the financial firms to report their SFTs to an approved EU trade repository.

Securities Financing Transactions (SFTs), these majorly are financial activity in which securities are taken for cash, or vice versa. Primarily these transactions are mostly consisting of repurchase agreements (repos), securities lending activities, and sell/buy-back transactions. These transactions result in temporary change of ownership of the securities, in return for cash temporarily changing ownership. Lastly during any security financial transaction, at the end of transaction the ownership reverts, and the two dealing parties are remained with what the initially possessed deducting a very small fee. In this regard, they act like collateralized loans.