Introduction

A Collective Investment Scheme (CIS), as its name suggests, is an investment scheme wherein several individuals come together to pool their money for investing in a particular asset(s) and for sharing the returns arising from that investment as per the agreement reached between them prior to pooling in the money.

The term has broader connotations and includes even mutual funds. For instance, in UK, the unit trust scheme is a collective investment scheme. However, in India, as in US, the definition of CIS excludes mutual funds or unit trust schemes etc and is given a strict definition in Section 11AA of the SEBI Act, 1992. CISs are regulated by the securities market regulator – SEBI – under SEBI (Collective Investment Scheme) Regulations, 1999.

History of CIS in India

In 1990s there were various instances of collection of money by numerous agro-based and plantation companies, which eventually failed to provide any return on the investments (despite promising around 18-30% returns) including the repayment of principal amount. In this context, the Government of India, vide its press release dated November 18, 1997, decided that an appropriate regulatory framework for regulating entities which issue instruments like agro bonds, plantation bonds etc., will be put in place. The government decided that the schemes through which such instruments are issued would be treated as “Collective Investment Schemes” (CIS) coming under the provisions of the SEBI Act.

In 2013, in the backdrop of Sahara / Sharada scams, SEBI modified the definition of CIS to include any scheme / arrangement floated by any person (instead of a company as was defined earlier); and any such scheme with corpus of more than Rs. 100 Crore shall also be deemed to be a CIS by SEBI.

The contributions, or payments made by the investors, by whatever name called, are pooled and utilized solely for the purposes of the scheme or arrangement

The contributions or payments are made to such scheme or arrangement by the investors with a view to receive profits, income, produce or property, whether movable or immovable, from such scheme or arrangement

The property, contribution or investment forming part of scheme or arrangement, whether identifiable or not, is managed on behalf of the investors

Debt management

According to Section 11AA of the SEBI Act, CIS is any scheme or arrangement, which satisfies the following conditions:

Any investment made or offered by a co-operative society

Investment under which deposits are accepted by non-banking financial companies

If investment made as being a contract of insurance

Investment made for any scheme, Pension Scheme or the Insurance Scheme framed under the Employees Provident Fund

Investment made under which deposits are accepted under section 58A of the Companies Act, 1956

Under which deposits are accepted by a company declared as a Nidhi or a mutual benefit society

Falling within the meaning of Chit business as defined in clause (d) of section 2 of the Chit Fund Act, 1982(40 of 1982)

Under which contributions made are in the nature of subscription to a mutual fund

However, as per the SEBI Act, the following activities have been exempted from the CIS Regulations. Any scheme or arrangement:

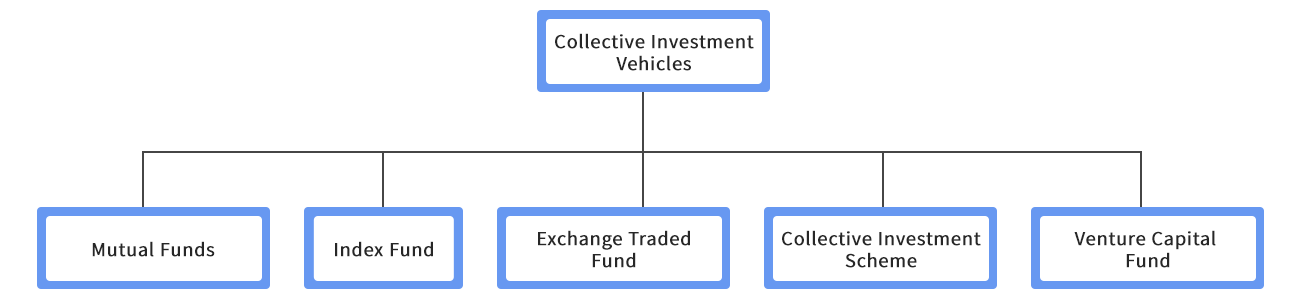

Collective Investment Vehicle

Difference between CIS and Mutual Funds:

Collective Investment Scheme (CIS) and Mutual funds (MF’s) are both types of Collective Investment Vehicle (CIV). CIV is any entity that allows investors to pool their money and this pooled funds is invested into securities or real estate by a professional manager.

CIS and MF are very similar, the only difference is that MF’s invests exclusively in securities (Stocks, Bonds, and others), whereas CIS confines its investments to plantation and real estate